Ethical Issues with Subprime Loans

Thursday, January 12, 2017

Measures taken to Prevent Subprime Financial Crisis Happening Again

To prevent a similar financial crisis happening again, the US Congress enacted the Wall Street Reform and Consumer Protection Act of 2010. The purpose was to bring sanity to Wall Street and bring to bear the consequences of financial poor judgement on organizational leaders. This law brought about the much needed regulation on big institutions that were previously thought as "too big to fail". Now they were required to report to the federal reserve on matters touching on liquidation.

Another measure taken to prevent another crisis were creation of the Consumer Financial Protection Bureau.

References

Total Quality Management image retrieved from https://www.google.com/search?q=consequences+of+subprime+lending&espv=2&biw=1280&bih=858&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjf6bDVyrzRAhVEJiYKHTy0ADUQ_AUIBygC#tbm=isch&q=preventing+the+subprime+financial+crisis+law&imgrc=XZhSQ__vf12OaM%3A

Compare and Contrast Resulting Consequences of Subprime Loans

Home ownership is the dream of every American. The subprime loans helped many people attain this dream albeit for a short time. Subprime loans enabled people to own homes benefiting in the short term. In the long term however, they lost their homes as they could not service their mortgage loan. According to Moore and Brauneis (2008), borrowers benefited from low borrowing costs for over 10 years.

The following graph shows how the subprime loans led to historical high home ownership in the US.

The following graph shows how the subprime loans led to historical high home ownership in the US.

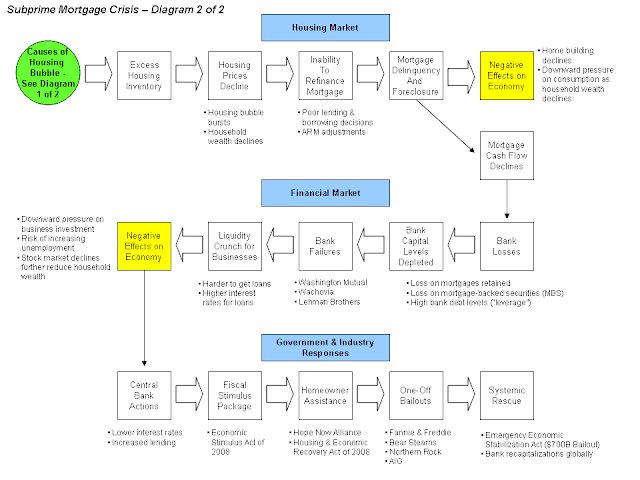

The following image captures the causes and consequences of the subprime loans in the US

References

Moore, M. A., & Brauneis, M. J. (2008, April). U.S. subprime crisis: Risk management’s next steps. Bank Accounting & Finance , 21(3), 18-48. Retrieved from http://eds.a.ebscohost.com.proxy1.ncu.edu/eds/detail/detail?sid=f17e9eff-61b7-4897-b426-5765ae8e78eb%40sessionmgr4002&vid=2&hid=4205&bdata=JnNpdGU9ZWRzLWxpdmU%3d#AN=31805667&db=bth

Annual Homeownership diagram. Retrieved from https://www.google.com/search?q=consequences+of+subprime+lending&espv=2&biw=1280&bih=858&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjf6bDVyrzRAhVEJiYKHTy0ADUQ_AUIBygC#imgrc=C0qrMaoqG3sQKM%3A

Subprime Mortgage Crisis diagram. Retrieved from https://www.google.com/search?q=consequences+of+subprime+lending&espv=2&biw=1280&bih=858&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjf6bDVyrzRAhVEJiYKHTy0ADUQ_AUIBygC#imgrc=CDAqN4zGooUNRM%3A

Critique of the Role of Leadership Decision-making in the Subprime Loan Financial Crisis

The subprime loan financial crisis would have been avoided if the leaders of the companies involved made the right decisions. Obviously, the leaders were driven by profit motive, but blinded by greed, the lending companies went overboard and decided to loan money to people that may not be able to repay the loans. Gilbert (2010) gives an in depth analysis of the parties involved in this crisis. The following were responsible for the subprime loan financial crisis:

References

- Mortgage brokers who failed to validate incomes through asking the right questions among other things

- Borrowers who lied in their applications

- Securitizers who combined individual mortgage loans into bundles and the subsequent collateralization of mortgage obligation

- Rating agencies who gave higher rating to the collateralized mortgage obligation

- Investors who purchased investment without due diligence.

References

Gilbert, J. (2011, Spring). Moral Duties in Business and Their Societal Impacts: The Case of the Subprime Lending Mess. Business & Society Review, 116(1), 87-107. http://dx.doi.org/10.1111/j.1467-8594.2011.00378.x.

Subprime Loans Summary

What is subprime loans?

A subprime loan is a type of loan that is made out to borrowers with lower credit ratings. In other words, these are borrowers who present a higher risk that the loan won't be repaid.

Subprime loans played a significant role in the 2008 financial crisis and the subsequent economic recession. In 2007, the US economy experienced an out-of-control number of mortgage failures leading to unprecedented number of foreclosures. More than half of these foreclosures in the US were as a result of the subprime mortgage loans.

Subprime loans have inherent risks both to the borrower and the lender. To the borrower, subprime loans had the risk that they were adjustable rate mortgages (ARMs). This means that the interest rate would adjust or change overtime. Overtime, the adjusted time interest rate would interest rate become unaffordable to the borrower leading to imminent foreclosure.

To the lender, subprime loans presented a different type of risk. Since the loans were given to borrowers who fell in the risky category, they attracted a higher interest rate which led to nonpayment or increased rates of default. To cover this risk, the lenders sold the mortgage debt to other intermediaries further compounding the problem.

References

Gilbert, J. (2011). Moral Duties in Business and Their Societal Impacts: The Case of the Subprime Lending Mess. Business & Society Review, 116(1), 87-107. doi:10.1111/j.1467-8594.2011.00378.x

Pajarskas, V., & Jočienė, A. (2014). Subprime Mortgage Crisis In The United States In 2007-2008: Causes and Consequences (Part I). Ekonomika / Economics, 93(4), 85.

Ross, L. M., & Squires, G. D. (2011). The Personal Costs of Subprime Lending and the Foreclosure Crisis: A Matter of Trust, Insecurity, and Institutional Deception. Social Science Quarterly (Wiley-Blackwell), 92(1), 140-163. doi:10.1111/j.1540-6237.2011.00761.x

Wednesday, January 11, 2017

About this Blog

This blogs aims at providing a platform for discussion on ethical issues touching on subprime loans. The blog seeks to explain the concept of subprime loans and summarizes the risks they pose to the lender and borrower. A critique of the role of leadership decision-making in the subprime loan financial crisis is given in the blog. The blog gives an evaluation of subprime loans with the notion of social responsibility. The resulting consequences of subprime loans are analysed in the blog. Finally, the blog explores the measures that have been taken since subprime loan financial crisis to prevent a repeat of the same.

Subscribe to:

Posts (Atom)